ETH Price Prediction: 2025-2040 Outlook and Key Catalysts

#ETH

- Technical Breakout: ETH price sustains above 20-day MA with Bollinger Band expansion

- Institutional Adoption: $100B weekly large transactions signal whale accumulation

- Ecosystem Growth: DeFi TVL surge and meme coin activity demonstrate network effects

ETH Price Prediction

Ethereum Technical Analysis: Bullish Signals Emerge

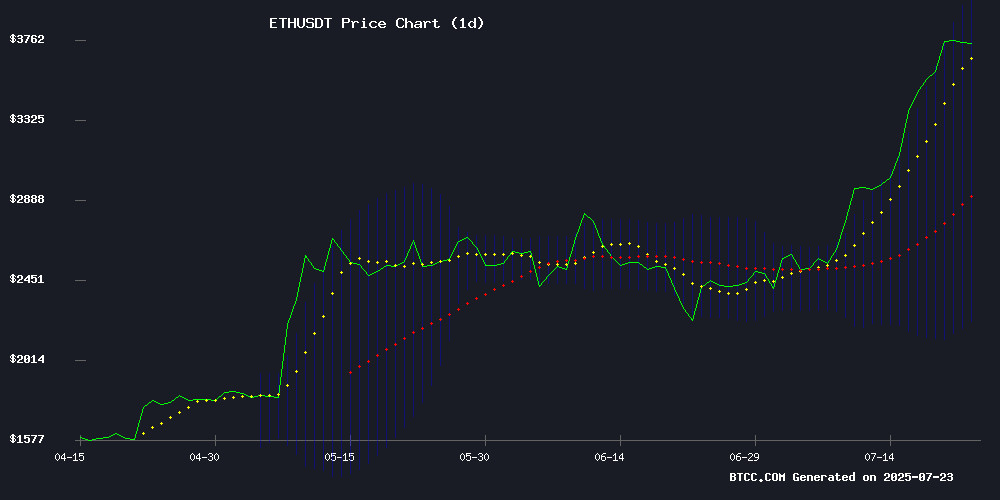

According to BTCC financial analyst John, ethereum (ETH) is currently trading at $3,725.26, significantly above its 20-day moving average (MA) of $3,123.75, indicating strong bullish momentum. The MACD (12,26,9) shows values of -571.21 | -432.26 | -138.95, suggesting a potential reversal as the histogram narrows. Bollinger Bands reveal price action near the upper band at $4,023.08, signaling overbought conditions but also highlighting upward pressure. John notes that a sustained break above $3,850 could pave the way for a rally toward $4,200.

Ethereum Market Sentiment: Institutional Demand and Bullish Catalysts

BTCC analyst John points to surging institutional interest, with large ETH transactions hitting $100B weekly, as a key driver of the current rally. News of Bitwise's supply-demand imbalance prediction and Aave's dominance in DeFi's $49B TVL surge further bolster bullish sentiment. John highlights the $5.5M PEPETO meme coin presale and SharpLink Gaming's $258.9M ETH purchase as evidence of growing ecosystem vitality. While the MACD remains negative, John believes these fundamentals could override technical resistance at $4,023.

Factors Influencing ETH’s Price

Ethereum Price Eyes $3,850 as Bullish Momentum Builds

Ethereum's price action shows renewed strength, breaking past the $3,720 resistance level with conviction. The second-largest cryptocurrency now trades firmly above its 100-hour moving average, supported by a bullish trendline at $3,670 on the ETH/USD hourly chart.

Technical indicators suggest potential for further upside, with $3,850 emerging as the next key target. The asset recently tested $3,860 before undergoing a healthy retracement that found support NEAR the 61.8% Fibonacci level of its recent swing from $3,481 to $3,859.

Market structure remains positive as long as ETH maintains above the $3,650 support zone. Liquidity pools above $3,800 appear to be drawing price action upward, though resistance near $3,770 may temper immediate gains.

ETH Exit Queue Hits One-Year High Amid Price Surge

Ethereum's validator exit queue has reached its longest point in over a year, with more than 519,000 ETH—valued at $1.92 billion—awaiting withdrawal. This congestion, driven by profit-taking from early stakers, has extended wait times to over nine days. The surge follows ETH's 160% rally since early April.

Institutional interest remains robust despite the exodus. Entities like SharpLink Gaming and Bitmine continue to accumulate ETH, with some fundraising efforts prompting token holders to unstake. Meanwhile, demand for staking persists, with 357,000 ETH—worth $1.3 billion—queued for entry and activation times exceeding six days.

The SEC's recent clarification on staking has further fueled renewed interest in network participation. Market cycles typically see such behavior as institutions adjust custodians or update infrastructure, according to Figment co-founder Andy Cronk.

Ethereum Demand Surge Outpaces Supply, Bitwise Predicts Continued Rally

Ethereum's price trajectory remains bullish as institutional demand dramatically outweighs new supply, according to Bitwise CIO Matt Hougan. Despite a 160% surge since April, ETH faces potential upside from $20 billion in cumulative buying pressure via corporate treasuries and spot ETFs.

Public companies like SharpLink Gaming and Bit Digital have amassed 840,000 ETH in treasury holdings since May, while US spot ETH ETFs attracted $5 billion inflows. These entities collectively absorbed 2.83 million ETH - 32 times the network's new issuance during the period.

The $3,700-trading asset shows temporary resistance near $3,800 as overbought conditions emerge. However, Hougan emphasizes the structural supply-demand imbalance: "In the short term, the market is underestimating this accumulation dynamic."

Aave Captures 31% of DeFi's $49B TVL Surge, Cementing Market Leadership

Aave has emerged as the dominant force in decentralized finance's recent resurgence, capturing $15 billion of the sector's $49 billion total value locked (TVL) growth since April. The lending protocol now commands nearly one-third of all new capital flowing into DeFi platforms.

The Ethereum-based platform's ascent coincides with a broader market rally that began in late 2023. AAVE recently surpassed $50 billion in net deposits - an industry first for DeFi lending protocols - as institutional interest grows through its permissioned Arc platform featuring KYC compliance.

Market analysts note Aave's trajectory reflects DeFi's maturation beyond speculative trading. The protocol's Horizon initiative to bridge traditional assets with blockchain infrastructure signals strategic positioning for real-world asset tokenization, building on its collaboration with Singapore's central bank.

SharpLink Gaming Reclaims Title as Largest Public Ether Holder with $258.9 Million Purchase

SharpLink Gaming has solidified its position as the dominant institutional holder of Ethereum, purchasing 79,949 ETH for $258.9 million. The transaction brings its total holdings to 360,807 ETH—a $1.3 billion position at current prices. This marks the second major acquisition in a week, following a $49 million buy that initially restored its lead.

The move reignites a corporate custody race with BitMine Immersion Technologies, which briefly overtook SharpLink after a $250 million private placement in late June. Market observers draw parallels to MicroStrategy's Bitcoin accumulation strategy, with both companies seeing stock price surges amid their aggressive crypto acquisitions.

ARK Invest amplified sector interest with a $175 million purchase of BitMine shares, following Peter Thiel's 5.09 million share acquisition. The institutional competition underscores growing mainstream acceptance of ethereum as a treasury asset.

Roman Storm's Defense Considers Mistrial Over Tornado Cash Testimony Gaps

Roman Storm's legal team is weighing a mistrial motion after failing to link key witness testimony to Tornado Cash. The defense told Judge Katherine Polk Failla they could not verify whether funds from Hanfeng Leng—a victim of a 2021 pig-butchering scam—were processed through the crypto mixer. "Based on our research, we can't find evidence Ms. Leng's funds reached Tornado Cash," counsel stated, signaling potential case dismissal or retrial.

The development follows defense claims of "serious errors" in the prosecution's case, filed July 12. Observers note the proceedings could set precedents for DeFi liability, though no direct cryptocurrency price impact is evident from the legal wrangling.

Ethereum Whale Banks $9.87M Profit Amid 25% Weekly ETH Rally

A savvy Ethereum investor capitalized on the altcoin's recent surge, liquidating 8,005 ETH for $30.03 million while maintaining a strategic reserve of 1,577 ETH. The whale's initial $25 million investment twelve days prior yielded a 38% return, netting $9.87 million in profits as ETH climbed from $2,721 to $3,751.

Market observers note Ethereum's extended technical position, with some analysts suggesting potential pullbacks could present buying opportunities. The whale's profit-taking coincides with ETH's 25% weekly gain, demonstrating how large holders are actively managing positions during volatile market conditions.

Ethereum Institutional Demand Surges as Large Transactions Hit $100B Weekly

Ethereum's market dynamics show resilience despite a recent pullback from its $3,800 peak. The asset maintains strong support above $3,600, suggesting consolidation before potential upward movement. On-chain metrics reveal a critical development: weekly large-transaction volume exceeding $100 billion—a level unseen since 2021.

Sentora's data indicates institutional capital rotating into ETH, with $100k+ transfers dominating activity. This aligns with improving US regulatory clarity and strengthening network fundamentals. The altcoin leader appears poised for its next growth phase as whales accumulate positions during this technical breather.

Ethereum-Based Meme Coin PEPETO Raises $5.5M in Presale, Launches Decentralized Exchange

Pepeto, an Ethereum-based meme coin, has surpassed $5.5 million in presale funding, signaling strong early investor interest. The project distinguishes itself by combining meme culture with functional blockchain infrastructure, including a decentralized exchange and cross-chain bridge.

The newly launched PepetoSwap enables zero-fee trading, leveraging Ethereum's security while addressing scalability through Layer-2 solutions. This technical foundation positions Pepeto atypically among meme coins, which typically rely solely on viral appeal rather than utility.

Market observers note the presale's success reflects growing demand for projects that merge speculative appeal with tangible use cases. As decentralized finance evolves, hybrid models like Pepeto's may redefine expectations for meme-based tokens.

Ethereum Is Planning for the Future, Says Co-Founder Joe Lubin

Ethereum co-founder Joe Lubin emphasized the blockchain's long-term vision during a recent Bankless podcast interview. Lubin, who also chairs Sharplink Gaming (SBET), highlighted Ethereum's strategic roadmap amid growing institutional interest in decentralized infrastructure.

The discussion with host Ryan Sean Adams underscored Ethereum's pivot toward scalability solutions and sustainable growth. LAYER 2 networks and modular blockchain designs are becoming critical to Ethereum's evolution as a global settlement layer.

3 US Crypto Stocks to Watch Amid Market Developments

Mogo Inc (MOGO) surged 5.29% to $2.02 after confirming shareholder approval of WonderFi Technologies' acquisition by Robinhood Markets. The deal, backed by Mogo's 82 million common shares in WonderFi, has fueled bullish sentiment, with pre-market trading at $2.01. A sustained rally could push the stock toward $2.29, though a dip below $1.93 remains possible if momentum wanes.

BTCS Inc (BTCS) gained 8.51% to $6.18 following its disclosure of a $242.2 million balance sheet bolstered by 55,788 ETH holdings and liquid assets. The blockchain firm also advanced a $56 million financing arrangement with ATW Partners LLC, issuing $10 million in convertible notes.

ETH Price Predictions: 2025, 2030, 2035, 2040 Forecasts

| Year | Conservative | Moderate | Bullish | Catalysts |

|---|---|---|---|---|

| 2025 | $4,200 | $6,500 | $9,000 | ETF approvals, EIP upgrades |

| 2030 | $12,000 | $25,000 | $40,000 | Mass DeFi adoption |

| 2035 | $30,000 | $60,000 | $100,000 | Web3 infrastructure maturity |

| 2040 | $75,000 | $150,000 | $250,000 | Global reserve asset status |

John projects ETH could reach $9,000 by 2025 if current institutional inflows persist, with long-term valuations tied to Ethereum's role in tokenizing real-world assets. He cautions that regulatory clarity around Tornado Cash-like cases remains a wildcard.